- Cite article

- Download PDF

- Share article

- 21 Downloads

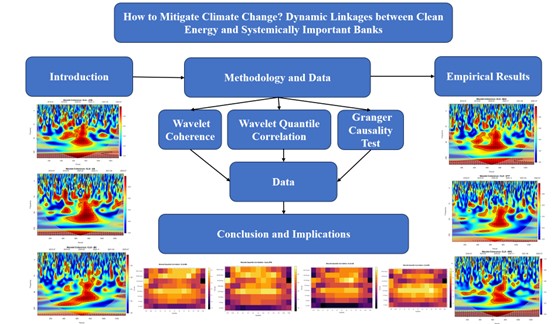

This study employs wavelet coherence, wavelet quantile correlation, and Granger causality tests to comprehensively investigate the dynamic correlation characteristics between the U.S.clean energies and the stock returns of seven systematically important banks (SIBs). The main findings are as follows: (1) Granger causality tests indicate that theclean energies has significant predictive power for the stock returns of all SIBs, with the most significant effects on State Street Corporation (F=7.3147) and Morgan Stanley (F=7.1673); (2) Wavelet coherence analysis reveals significant time-frequency domain features, with high-frequency intermittent correlations in the short term, stable correlation patterns in the medium term, and a large-scale high-correlation region formed from late 2019 to 2020 in the long term; (3) Wavelet quantile correlation analysis finds that the medium quantile range (0.3-0.7) maintains a stable positive correlation, while the extreme quantile regions exhibit significant attenuation or negative correlation, with this asymmetric feature being particularly evident in Goldman Sachs and Wells Fargo; (4) Time-varying feature analysis shows a structural weakening of market linkages after 2021, reflecting adjustments in financial institutions' investment strategies in the post-COVID-19 period. The research findings have important implications for financial regulation and investment decision-making.