-

Topic

-

VolumeVolume 28 (2026)

-

Issue

-

Pages1-28

- gnest_07789_final.pdf

-

Paper IDgnest_07789

-

Paper statusPublished

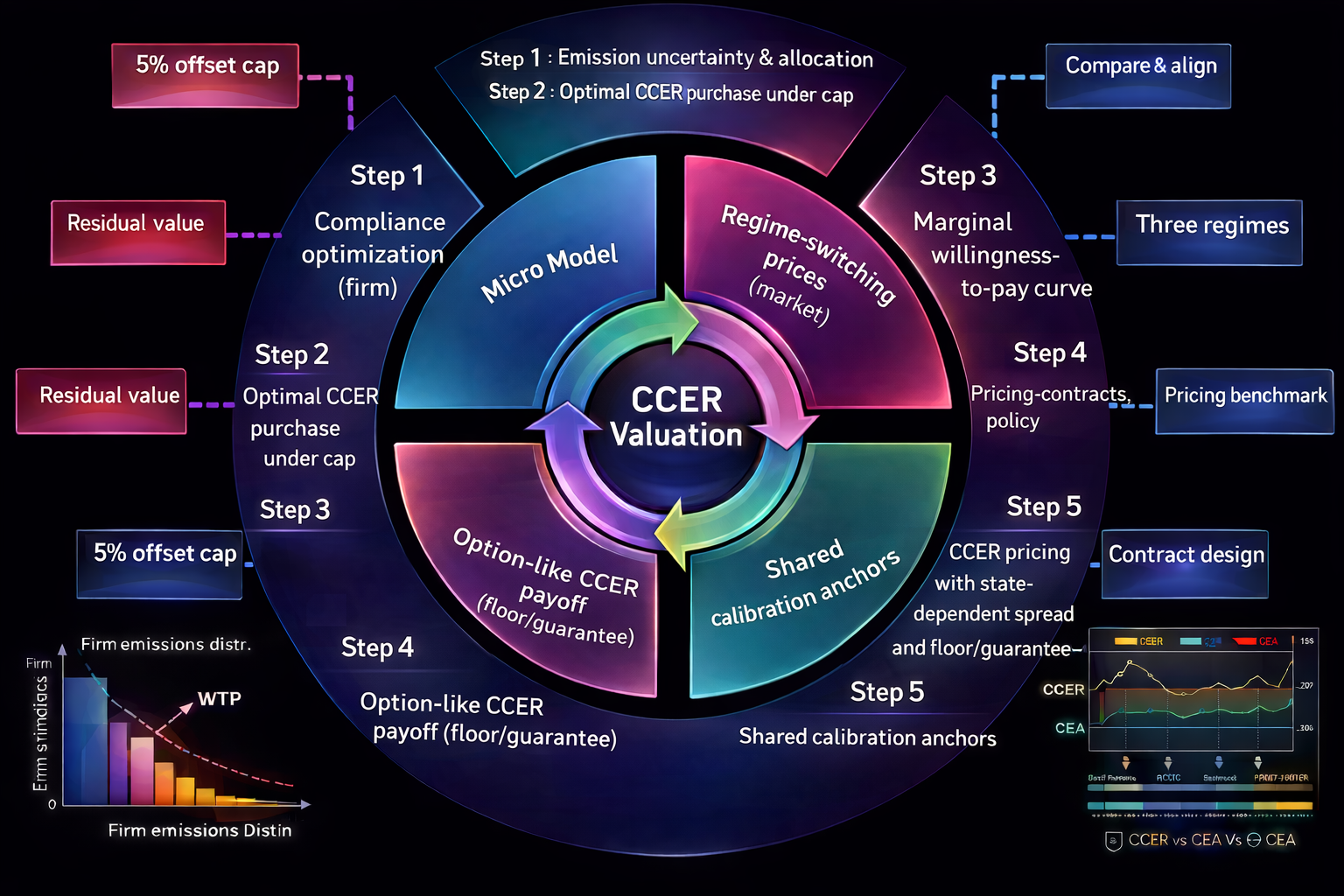

This paper develops an integrated framework to value China Certified Emission Reductions (CCER) in the context of the national emissions trading system. At the micro level, we refine the income approach by endogenizing firms' CCER purchase decisions under emission uncertainty, offset caps and residual value risk, deriving a closed-form marginal willingness-to-pay schedule linked to firm-specific emission distributions, allowance allocations and policy parameters. At the macro level, we model carbon prices with a three-regime switching geometric Brownian motion calibrated to Beijing carbon market and electricity data, and price CCER as a real-option-like asset with state-dependent CEA-CCER spreads and guarantee-type payoffs. Comparing the two layers, we show how income-based benchmarks and regime-switching option values differ yet can be aligned to inform CCER pricing, contract design and policy reform in China's carbon market.

Total file downloads: 1