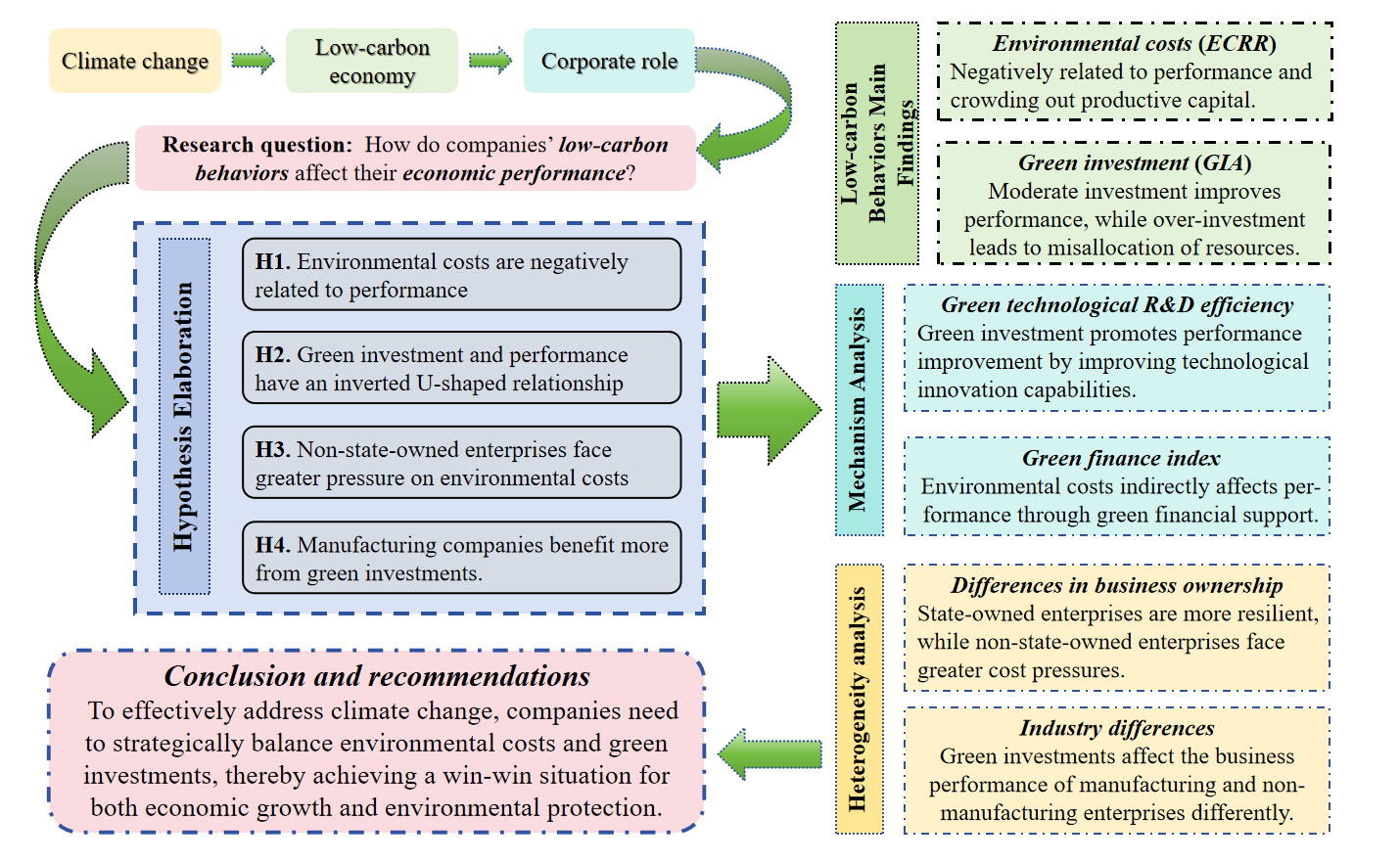

As global climate change and management challenges grow, the low-carbon transition has become crucial for the sustainable development of enterprises. This study investigates the economic impact of corporate low-carbon behavior on operational performance using panel data from 2008 to 2022 for publicly listed Chinese companies. We find that the environmental cost-to-revenue ratio (ECRR) is negatively correlated with performance, indicating that higher environmental expenses short-term crowd out productive capital. In contrast, the green investment-to-assets ratio (GIA) exhibits an "inverted U-shaped" relationship with performance, with moderate investment enhancing performance through innovation, while excessive investment leads to resource misallocation and cost increases. Heterogeneity analysis shows that state-owned enterprises are more resilient to environmental costs, while non-state-owned enterprises (NSOEs) face greater cost pressures and performance risks. Additionally, green investment has a more significant positive impact on manufacturing firms due to their higher resource consumption and carbon intensity. This study also explores the transmission mechanisms through which green investment and environmental expenses affect performance via green technology R&D and green finance, respectively. These findings provide valuable insights for enterprises to balance environmental protection with economic benefits in their low-carbon transition.

Total file downloads: 41