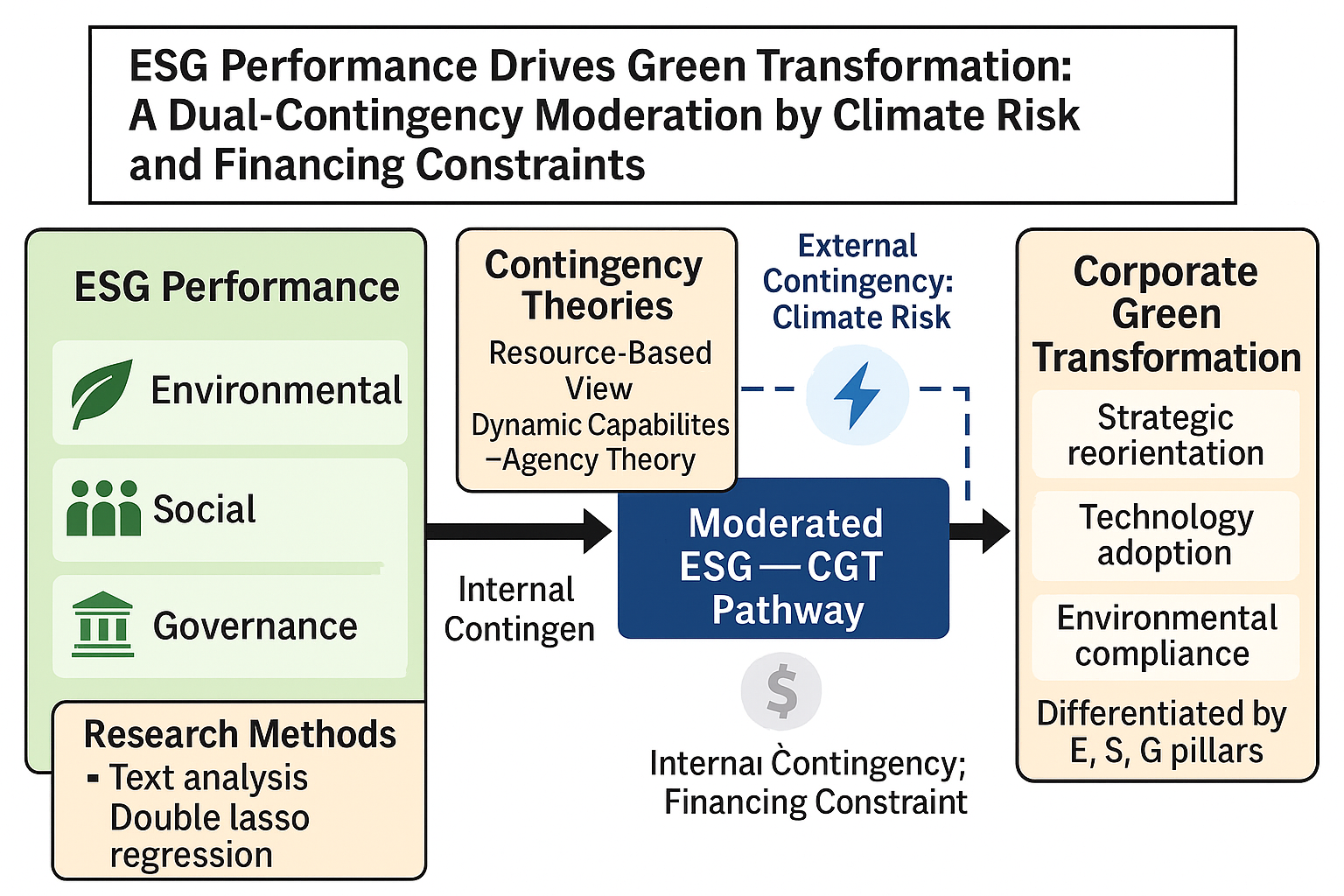

In the face of accelerating climate change and rising stakeholder expectations, Environmental, Social, and Governance (ESG) strategies have emerged as vital instruments in guiding corporate green transformation. Whether these programs are effective in achieving sustainability, however, still depend on firms’ unique contexts. Therefore, this study develops a dual-contingency model that integrates Contingency Theory with the Resource-Based View and Dynamic Capabilities Theory to determine the combined effects of external climate risk and internal financing limitations on the ESG–sustainability relationship. We apply text-mining and double-selection LASS estimation to analyze a panel dataset of Chinese listed firms from 2009 to 2023. The results indicate that of the three ESG dimensions, the environmental and governance pillars significantly enhance firms’ green transformation. This effect, nonetheless, is weakened by climate risk and financing limitations, confirming ESG’s context-specific impact. Our findings add to the theoretical knowledge of ESG’s dynamic mechanism and provide firms actionable recommendations in managing both environmental and resource volatilities.

Total file downloads: 25