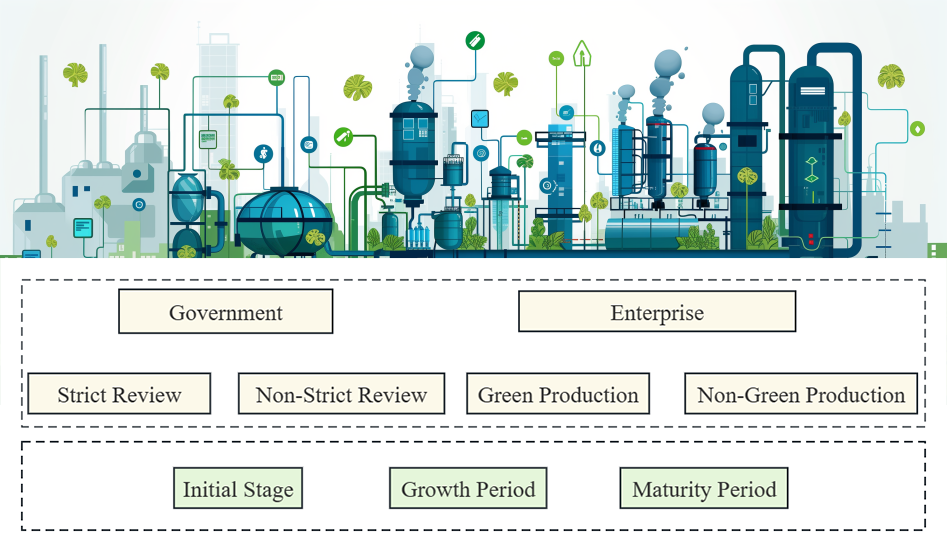

The green finance market, as an integral part of the circular economy, significantly influences environmental protection and sustainable development. This study explores regulatory issues concerning corporate "greenwashing" behavior in this market, aiming to devise effective regulatory strategies to promote genuine green economic activities. By applying evolutionary game theory, this paper constructs a game model of interaction between the government and enterprises. Through numerical simulation analysis, it reveals the dynamic characteristics of the green finance market in three different stages: initial, growth, and maturity, and their impact on system stability. The study suggests that strengthening regulatory measures, enhancing transparency in information disclosure, establishing unified green assessment standards, and improving incentive policies are key measures to curb corporate greenwashing behavior and promote green transformation. The implementation of these strategies not only enhances the market's green reputation but also encourages active participation of enterprises in circular economic activities, thereby achieving a win-win situation for environmental and economic benefits. The research findings of this paper have important theoretical and practical implications for guiding the healthy development of the green finance market and formulating circular economy policies.

Total file downloads: 31