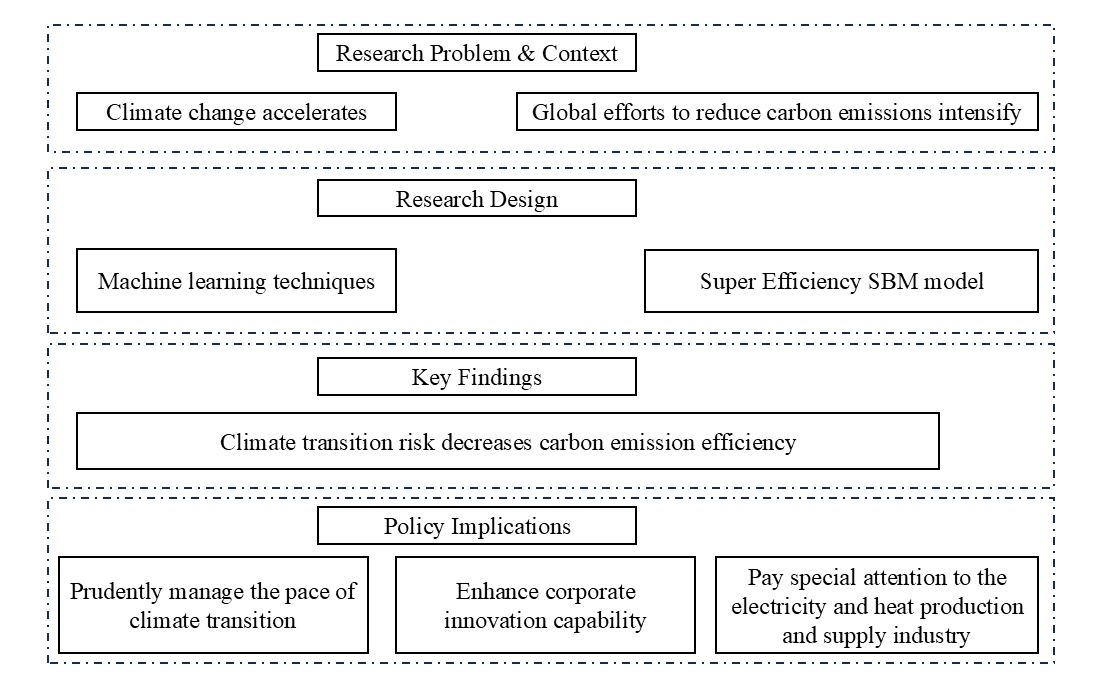

Climate change acceleration and intensifying global carbon reduction efforts have created an urgent need to understand how climate transition risks affect carbon emission efficiency in energy enterprises. Our study breaks new ground by developing climate risk indicators through machine learning and textual analysis of Chinese A-share listed companies' annual reports (2016-2022). Employing the Super Efficiency SBM model, we explore the complex relationship between transition risk and emission efficiency. Results indicate that transition risk initially hampers efficiency, though we found that robust innovation capabilities can buffer these negative effects. Interestingly, heterogeneity tests reveal that impacts are particularly pronounced within the electricity industry. These findings contribute meaningful insights for environmental policy development while offering practical guidance to energy enterprises grappling with emission reduction challenges.

Total file downloads: 29